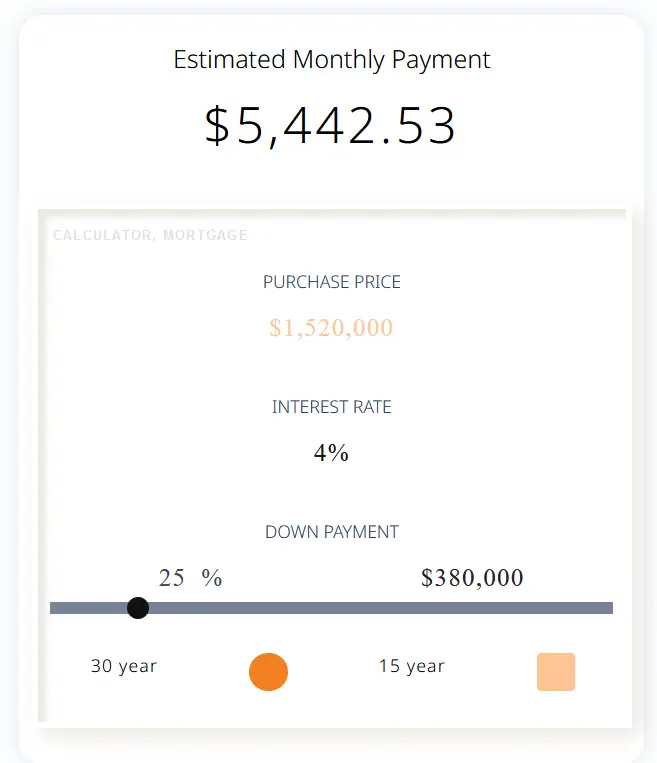

Estimated Monthly Payment

$256.89

A mortgage calculator is a tool used to determine the amount of loan taken to buy a property. To use the calculator, follow these steps:

Input the purchase price in the designated "purchase price" box.

Adjust the down payment by sliding the bar.

Choose the desired mortgage term.

Specify the interest rate by moving the slider.

A mortgage is a loan that is taken out to purchase a property, typically a house or a piece of land. The borrower (also known as the mortgagor) gives the lender (also known as the mortgagee) a legal claim on the property as collateral for the loan. The borrower pays back the loan in installments, which consist of both the principal amount borrowed and interest charges.

In this type of mortgage, the interest rate remains constant throughout the loan term. For example, let's say you take out a mortgage of $200,000 with a fixed interest rate of 4% for a 30-year term. The monthly payments would be calculated based on the principal and interest, and they would remain the same over the 30 years. The total amount paid over the loan term would include both the principal and the interest.

In this type of mortgage, the interest rate can change periodically. For example, let's consider a scenario where you take out an adjustable-rate mortgage of $300,000 with an initial interest rate of 3% for a 5/1 ARM (Adjustable Rate Mortgage). This means that the interest rate will remain fixed for the first 5 years and then adjust annually based on a predetermined index, such as the U.S. Prime Rate. After the initial fixed-rate period, the interest rate can increase or decrease, which will impact the monthly payments.

1. Monthly Payment Calculation: This involves calculating the amount of the monthly payment based on the loan amount, interest rate, and loan term. Various formulas, such as the amortization formula, can be used to calculate the monthly payment.

2. Interest Calculation: This involves calculating the amount of interest paid over the loan term. The interest is typically calculated based on the remaining loan balance and the interest rate.

3. Total Cost Calculation: This involves calculating the total amount paid over the loan term, including both the principal and interest. This can be calculated by multiplying the monthly payment by the number of months in the loan term.

It's important to note that mortgage calculations can be complex and involve factors such as down payments, closing costs, and escrow accounts. It's recommended to use specialized mortgage calculators or seek professional advice when dealing with mortgage calculations.